Surely you or people who see this article already know about Bitcoin? Ethereum (ETH) was once considered an alternative cryptocurrency to Bitcoin (BTC).

So is Ethereum special that can be compared with BTC? Why is it the second largest cryptocurrency on CoinMarketCap after Bitcoin?

How is it different from Bitcoin? Should we invest in this property or not?…

In this article, fptwaze.com will bring you all about Ethereum. Let’s see the article together!

Contents

- 1 General

- 2 What is Ethereum (ETH)?

- 3 What is Ethereum 2.0?

- 4 Ethereum 2.0 Chain

- 5 How many stages to complete ETH 2.0?

- 6 What stage of ETH 2.0 are we at?

- 7 Project’s competitors

- 8 How does Ethereum work?

- 9 Client and node

- 10 Application built on Ethereum

- 11 Ethereum Apps You Might Be Using

- 12 Other applications

- 13 Decentralized Ethereum Platform Review

- 14 Why does Ethereum not have a maximum supply?

- 15 Ways to Earn Ethereum

- 16 Should you invest in Ethereum or not?

- 17 Which wallet is safe to store Ethereum in?

- 18 Conclusions

General

| Name | Ethereum |

| Symbol | ETH |

| Author | Vitalik Buterin, Gavin Wood |

| Date of birth | 30 July 2015 |

| Maximum total supply | No |

| Official domain name | https://ethereum.org/ |

| Language development | C++, Go, Python |

| Source code | https://github.com/ethereum |

| White Paper | https://github.com/ethereum/wiki/wiki/white-paper |

What is Ethereum (ETH)?

Ethereum is a blockchain distributed computing platform running on Blockchain technology, through the use of smart contract functionality.

Ethereum can perform transactions, peer-to-peer network contracts through the cryptocurrency unit Ether (ETH).

Not only that, they are also considered a useful application platform and create their own distributed financial ecosystem.

Ethereum was introduced end of 2013 by Vitalik Buterin, with the desire to create a coin that overcomes the shortcomings of Bitcoin.

And with the above “mission”, the capitalization of ETH has reached 25 million USD in the first sale.

According to the initial development roadmap, Ethereum will go through four important stages, including:

- Frontier

- Homestead

- Metropolis

- Serenity

As of December 2019, Ethereum has completed 3 phases and is about to enter phase 4.

However, there is an important change in this fourth phase when it is renamed to Ethereum 2.0.

What is Ethereum 2.0?

Ethereum 2.0 is also known as Serentity. This is a common name for several major Ethereum updates.

This update will solve Blockchain’s impossible trinity: security, network scalability, decentralization.

Ethereum 2.0 Chain

![]()

The main way to solve these 3 matters:

- Beacon Chain

- Proof of Stake (PoS)

- Sharding

- eWASM

Beacon Chain

Beacon chain is the core of Ethereum 2.0. This chain will run in parallel and cross-link between Main chain and Shard Chain.

Proof of Stake (PoS)

PoS is a consensus mechanism that will replace the current mechanism, PoW (Proof of Work). The conversion will be through a hybrid PoS and PoW consensus mechanism – the Casper Friendly Finality Gadget (FFG).

You can roughly understand that the value and system of Ethereum will no longer depend much on mines and miners.

So the system will get stronger and stronger and will no longer be influenced or dominated by miners.

Normally, an Ethereum transaction needs a miner to confirm, otherwise the transaction will fail.

Sharding

Sharding is a method of scaling transaction throughput on-chain. The method is implemented by splitting the large database into small databases.

Small chunks of data are called ‘shard’.

eWASM

Ethereum-flavored WebAssembly (eWASM) is a limited subset of WebAssembly(Wasm) used for futures contracts.

Each shard will include 1 eWASM equivalent to the Ethereum virtual machine.

Currently, there is no developer consensus for an EVM replacement. But the developer will have a plan.

How many stages to complete ETH 2.0?

To complete ETH 2.0, we need to go through 3 stages, including:

- Stage 0

- Stage 1

- Stage 2

Stage 0

The first Stage is the launch of Beacon Chain which will implement PoS on-chain. In this phase will also launch an asset class on the Beacon chain.

This asset class is called Beacon ether (BETH). BETH is considered as the authentic reward used to pay rewards to Staking people.

In addition, you can also own BETH by using ETH to buy. Each ETH will be equal to 1 Beacon ether.

This stage does not yet support sharding, smart contracts and asset transfer. So you won’t be able to withdraw BETH until sharding is possible in stage 2.

Stage 1

The next stage will shift focus to Shard Chain. Sharding breaks down state information into ‘shards’ to achieve scalability goals and improve network speed.

Stage 2

Stage 2 is considered Serenity’s final stage as it completes its base class upgrade, and this stage is set to happen sometime around 2021.

During this stage, the shard chain will transition to a structured chain state that supports smart contracts and asset transfers.

What stage of ETH 2.0 are we at?

As shared by Vitalik at the 2049 Token Conference held in March 2019, we have not yet entered any stage of ETH 2.0 (as of December 2019).

In the meantime, the Ethereum development team is finalizing the specifications. After that was the launch of the testnet and for some large companies to test the POS system.

However, according to Vitalik, the above stages can work in tandem without having to be in order.

Project’s competitors

Ethereum was once considered Bitcoin 2.0, but the success only stopped at the smart contract platform.

Although it is still the leader in smart contract platforms in terms of market capitalization, its influence is still small.

But the project competes with the one created to improve the limitations of the platform. Some of the names that can be mentioned are:

- Eos (EOS)

- Stellar (XLM)

- Cardano (ADA)

- NEO (NEO)

- Tron (TRX)

- Cosmos (ATOM)

Nearly 60% of dapps run on the Ethereum network, 17% on EOS, 17% on Tron – according to DappRada. But top 10 new dapps released on January 6, 2020, Ethereum accounts for 40% and Tron 40%.

How does Ethereum work?

The Ethereum blockchain is essentially a transaction-based state recorder. In computer science, a state machine refers to something that will read a series of inputs and, based on those inputs, will transition to a new state.

The state of Ethereum has millions of transactions. These transactions are grouped into blocks. A block contains a series of transactions and each block is connected to the previous block.

To make a transition from one state to the next, the transaction must be valid. For a transaction to be considered valid, it must go through a confirmation process known as mining. Mining is when a group of nodes (i.e. computers) use their computational resources to generate a block of valid transactions.

The process of validating each block by having a miner provide a mathematical proof is known as proof of work.

A miner who confirms a new block is rewarded with a certain amount of value for doing this work. That value is: The Ethereum blockchain uses an intrinsic digital token called Ether. Every time a miner proves a block, a new Ether token is generated and rewarded.

Client and node

The Ethereum network is made up of multiple nodes, each running compatible client software. There are two clients used by most nodes: Geth (written in Go) and Parity (written in Rust).

Application built on Ethereum

There are different types of applications that can be built on Ethereum. I will list for you the highlights including:

- Decentralized Finance (Defi)

- Decentralized Exchange (DEX)

- Decentralized Applications (Dapps)

…

Decentralized Finance (Defi) and Ethereum

Summary

In the existing system all financial services are controlled by an intermediary. Whether it’s transferring money, buying property, or making a loan, you must go through an intermediary that charges a rental fee to mediate financial transactions.

Ethereum-based financial services, on the other hand, connect individuals peer-to-peer and allow them to access assets more easily and at a more affordable cost.

Decentralized Finance Application on Ethereum

Ethereum is currently the platform with the most active defi applications. This section is probably also the applications you use the most, so I will list it first:

- Stablecoins: Simply understandin that they are cryptocurrencies designed to minimize the impact of price fluctuations. The fiat-backed cryptocurrency is the most popular and the first stablecoin on the market.

- Coinbase Wallet: A multi-currency wallet, Coinbase Wallet also provides access to Decentralized Web Applications (dApps) powered by Ethereum smart contracts.

- Huobi Wallet: Multi-currency wallet, dApps browser and staking as a service for PoS networks.

- MyEtherWallet: Free, open source, client-side interface for creating Ethereum wallets and interacting with dApps.

Trust Wallet: Versatile crypto wallet for storing BEP2, ERC20 and ERC721 tokens.

These are the apps that people use the most. In addition, it is possible to list the applications of ethereum with Defi such as: Lending, investment, Payment, insurance, prediction market, …

Decentralized Exchange (DEX) and Ethereum

Summary

This form of understanding cuts the risk of asset hacks and many other risks.

The form of decentralized exchange can be mentioned as: Peer-to-peer network, … Along with the peer-to-peer network in addition to the decentralized application dapp, this is where users interact with smart contract.

There is a very hot peer-to-peer trading platform called binance P2P.

Decentralized Applications (Dapps)

Decentralized dapp with peer-to-peer network, this is where users interact with smart contracts. This section is the part I expanded to list more for you who are just starting to use Ethereum, which can be easily accessed:

What makes Ethereum dapps different

Applications built on Ethereum (dapps) can do things that regular applications cannot:

Create new currencies and digital assets.

Web applications are unstoppable and uncontrollable.

Build decentralized organizations, jointly managed assets or virtual worlds.

Dapps on Ethereum are web applications powered by Ethereum smart contracts. Instead of using a centralized server or database, these applications rely on blockchain as a backend for mathematical logic and program storage.

This leads to unstoppable potential uses: Anyone can deploy a clone and freely connect it to the public Ethereum network.

Ethereum Apps You Might Be Using

Here is a list of Ethereum dapps you can use right now. Most are available to download for free through the Apple or Google Play stores or directly through their websites as demos, betas, or full releases.

Browsers, wallets and utilities:

- MetaMask: A browser plug-in that connects your device to the Ethereum network.

- Status: Ethereum mobile browser with token wallet, chat and dapp portal.

- Brave: A web and mobile browser integrated with BAT and ERC-20 tokens.

- Opera: Dapp browser with built-in Ethereum wallet.

- Ethereum Name Service: A utility for creating personalized and simple ETH wallet addresses.

- Civic: Identity security and data management on blockchain.

- Alethio: Ethereum network analytics platform.

Other applications

In addition to wallets, websites or gadgets. The application of ethereum also spans many other fields such as: Platform, market, Social network, game, …

Some examples for you to study are as follows:

- IDEX: A decentralized exchange with real-time trading and high transaction throughput.

- ForkDelta: A Decentralized Ethereum Token Exchange

Decentralized Ethereum Platform Review

Advantages

Third parties cannot make any changes to the data.

Applications rely on a network formed around the principle of consensus, making censorship impossible.

Applications are well protected against hacking attacks and fraudulent activity.

The app never stops working and can never be shut down.

Disadvangtes

Although it shows many benefits by decentralized applications. But besides that, we need to consider the following disadvantages:

Smart contract code is written by humans, so it’s mostly only good for the people who write them. Code or oversight errors can lead to unintended adverse actions. If a bug in the code is exploited, the mining can be stopped apart from getting network consensus and having to rewrite the code.

This goes against the nature of blockchain which is immutable. That is, no one can interfere with the data inside the blockchain

Value of Ethereum

The mining source of the miners determines the value of the ETH coin. Because this is a relatively young platform, often fluctuating in price, many people think that they are of little value and should not be invested.

But if you are a person who learns and follows ETH closely, you will realize that it offers many opportunities for investors.

Ethereum is an open market that allows users to easily participate in buying and selling, exchanging with cash or Bitcoin through exchanges or between groups, organizations, and individuals.

Especially in 2017 and 2018, Ethereum is the vehicle that helps many companies raise capital such as EOS, IOTA, etc.

In addition, in 2019, Ethereum still holds the 2nd position, but is no longer a HOT channel to raise capital and is gradually being replaced by other channels.

Maybe they will use Bitcoin, Binance Coin or Exchange Coins to raise capital. Therefore, the value of ETH will be changed, although the future is unknown.

So, remember to update the latest news from fptwaze before making an investment decision!

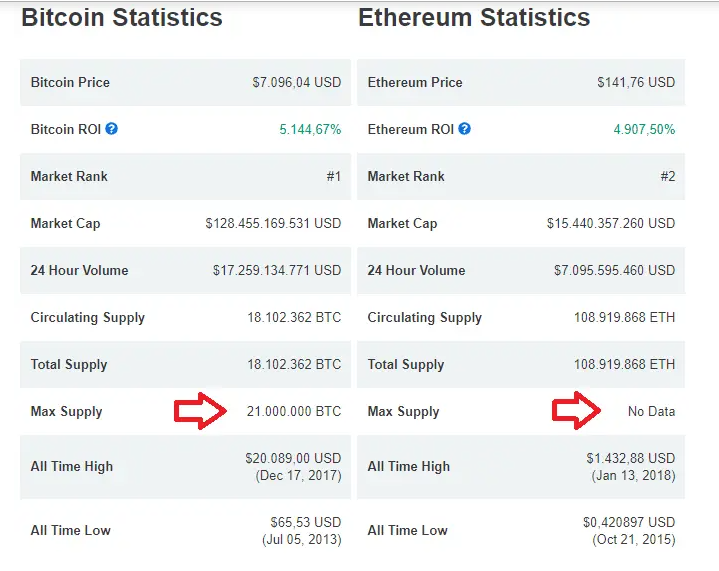

Why does Ethereum not have a maximum supply?

Unlike Bitcoin, ETH has absolutely no supply limit. Why is that so? Will this have any effect on the price of ETH? In the future, will the supply of ETH be capped?

According to the development team, Ethereum will not have a limited supply. Because the team doesn’t trust the same development path as Bitcoin.

According to the development team, Ethereum will not have a limited supply. Because the team doesn’t trust the same development path as Bitcoin.

For Bitcoin (built on the Proof Of Work algorithm), for the network to be safe, miners need to work (create blocks).

In return, miners will be rewarded with BTC and transaction fees for successful mining. However, the reward budget is not permanent as the total supply of Bitcoin is only 21 million BTC.

When 21 million BTC is mined, the reward for them is only transaction fees. At that time, there was no guarantee that miners would continue to work to secure the network.

That is why Vitalik Buterin realizes that building ETH on the Proof Of Work algorithm and having a limited supply is not a wise move.And the Ethereum 2.0 project was born which started with the hardfork of Istanbul.

Ways to Earn Ethereum

Dig yourself or join mining groups

To mine ETH is a process of competing to solve a problem of miners. On average, every 10 minutes, there will be one or a group of people who solve this problem and receive the corresponding amount of ETH.

However, the issue of investing in mining money and electricity is something that needs to be carefully considered if you want to become a miner.

So you can find mining groups or pool capital with friends. In addition, you can also buy a digger yourself.

But, this form to payback capital, you need a lot of time and effort.

Invest money to buy Ethereum

In addition to becoming a miner, you can spend money to buy ETH to own them. You can buy from friends (if any) or go to reputable ETH trading sites.

Become an ETH trader

This method is called “Surf investing”. Because the ETH price is often volatile and there are times when the difference is up to several tens/hundreds of USD in a short time.

So many people rely on this time, take time to research, choose the right time to buy ETH at a low price and then sell it at a high price.

Should you invest in Ethereum or not?

Whether or not to invest in ETH depends on each person’s point of view. In essence, you invest in this cryptocurrency just like you buy gold or play stocks.

If you know how to choose the right time to invest, the possibility of profit is very high; because the price of ETH is often volatile, similar to Bitcoin.

However, more and more countries are accepting Ethereum as a valid form of payment, even more so than Bitcoin.

Most countries do not accept Bitcoin because the management and security are not completely secure.

But with Ethereum, the developers have solved that problem, helping to ensure that transactions are safe and avoid being hacked.

The market for Ethereum is growing stronger and stronger. From a market capitalization of $25 million in 2014.

Until now, the capitalization of ETH has grown to over $15.5 billion. For a fast-growing market like Ethereum, investing in ETH seems like a very profitable opportunity.

In addition, you should regularly update news about this coin if you have a direction to invest it. Because important news in the world is a factor that directly affects the price of any coin.

Which wallet is safe to store Ethereum in?

Before buying Ethereum, what you need to do is create a wallet address (Wallet) to store your Ethereum.

So which wallet is safest and easiest for new investors to use? You can use “Online/hot wallet” or “Offline/cold wallet” depending on your needs.

If you often buy and sell, you should use a hot wallet, and if you plan to hold for a few months or a few years, you should use a cold wallet.

Hot wallets are web-based wallet platforms. Some of the most popular and widely used wallets are Blockchain.com, CoinBase or MyEtherWallet. In particular, MyEtherWallet is a specialized wallet to store tokens running on the Ethereum platform (ERC20).

Cold wallets are software wallets or USB wallets (shaped like a USB), such as Ledger Nano S, ledger nano X or Trezor.

However, one thing to keep in mind is that cold wallets are always safer than hot wallets.

Conclusions

So FPTwaze shared with readers the article “What is Ethereum? Should we invest in Ethereum or not?

We hope this article will bring you useful knowledge. If you have any questions, please comment below.

FPTwaze will answer for you as soon as possible.